Table of Contents

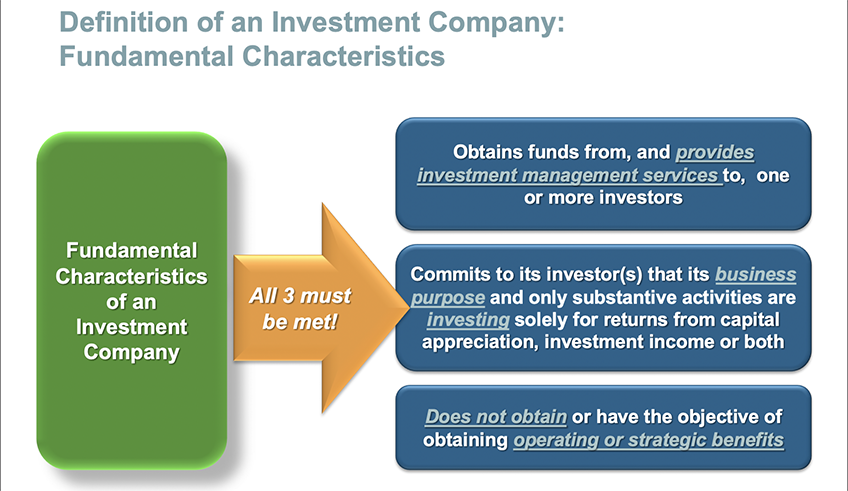

Banks A financial investment business is a monetary organization principally participated in holding, taking care of and spending safeties. These business in the United States are controlled by the U.S. Stocks and Exchange Commission and have to be signed up under the Investment Firm Act of 1940. Investment firm invest cash in support of their customers that, in return, share in the profits and losses.

.png?width=1733&name=Different_Types_of_Investment_Companies%20(1).png)

Financial investment companies do not consist of brokerage firm business, insurance coverage companies, or banks.

A major kind of firm not covered under the Financial Investment Business Act 1940 is private investment firm, which are just exclusive companies that make financial investments in stocks or bonds, however are restricted to under 250 capitalists and are not controlled by the SEC. These funds are frequently composed of extremely wealthy investors.

This supplies specific defenses and oversight for capitalists. Managed funds generally have restrictions on the types and quantities of investments the fund manager can make. Generally, regulated funds might just buy noted safety and securities and no even more than 5% of the fund might be purchased a solitary safety and security. Most of investment firms are shared funds, both in terms of number of funds and assets under management.

Mineral Rights Companies servicing Georgetown

The first investment company were established in Europe in the late 1700s by a Dutch trader who wished to allow tiny financiers to merge their funds and branch out. This is where the idea of investment firm stem, as stated by K. Geert Rouwenhorst. In the 1800s in England, "financial investment merging" emerged with trusts that appeared like modern mutual fund in structure.

New protections laws in the 1930s like the 1933 Stocks Act recovered financier confidence.

U.S. Securities and Exchange Compensation (SEC).

Investment Company in Georgetown, Texas

Lemke, Lins and Smith, Regulation of Investment Companies, 4.01 (Matthew Bender, 2016 ed.). ACM. 2023.

In retail financial investment funds, hundreds of financiers may be involved through intermediaries, and they might have little or no control of the fund's tasks or knowledge regarding the identifications of other investors. The prospective number of investors in a private mutual fund is generally smaller than retail funds. Private investment funds tend to target high-net-worth people, consisting of politically subjected individuals, and fund managers might have a close connection with their client financiers.

Passive funds have actually been expanding in their market share, and in some jurisdictions they hold a substantial part of ownership in publicly traded companies. There are several classifications for investment funds. Some are closed-end, meaning they have a fixed number of shares or capital, whilst others are open-end, meaning they can expand into limitless shares or funding.

The prices, threat, and regards to by-products are based on an underlying possession, and they permit investors to hedge a setting, rise leverage, or guess on an asset's change in value. A financier could possess both a stock and an option on the very same stock that allows them to offer it at a set rate; as a result, if the supply's price drops, the alternative still preserves worth, decreasing the financier's losses.

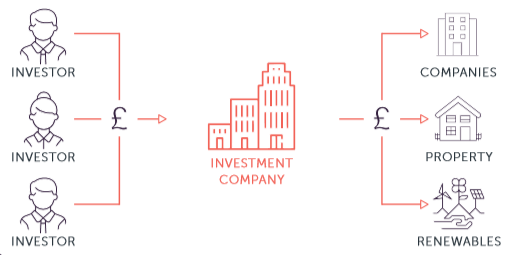

Whilst taken into consideration, provided the focus of this instruction on the robot of corporate vehicles, a complete therapy of the helpful possession of possessions is outside its range. A mutual fund offers as a conduit to take advantage of several possessions being held as investments. Capitalists can be people, business cars, or institutions, and there are typically a number of intermediaries in between the capitalist and mutual fund in addition to in between the financial investment fund and the underlying financial properties, especially if the fund's devices are exchange-traded (Box 1).

Investment Management in Georgetown

Relying on its lawful type and structure, the people exercising control of a financial investment fund itself can differ from the people who have and gain from the underlying properties being held by the fund at any type of offered time, either directly or indirectly. Both retail and private financial investment funds normally have fund supervisors or experts who make financial investment choices for the fund, choosing safeties that straighten with the fund's goals and run the risk of resistance.

and work as intermediaries in between financiers and the fund, helping with the trading of fund shares. They attach capitalists with the fund's shares and carry out professions on their part. handle the registration and transfer of fund shares, preserving a document of shareholders, processing ownership adjustments, and releasing proxy products for shareholder conferences.

Navigation

Latest Posts

Landscape Design around Georgetown, Texas

Mineral Rights Companies

Investment Company